Stormwater Assessment Fee

Why Is There A Stormwater Assessment Fee?

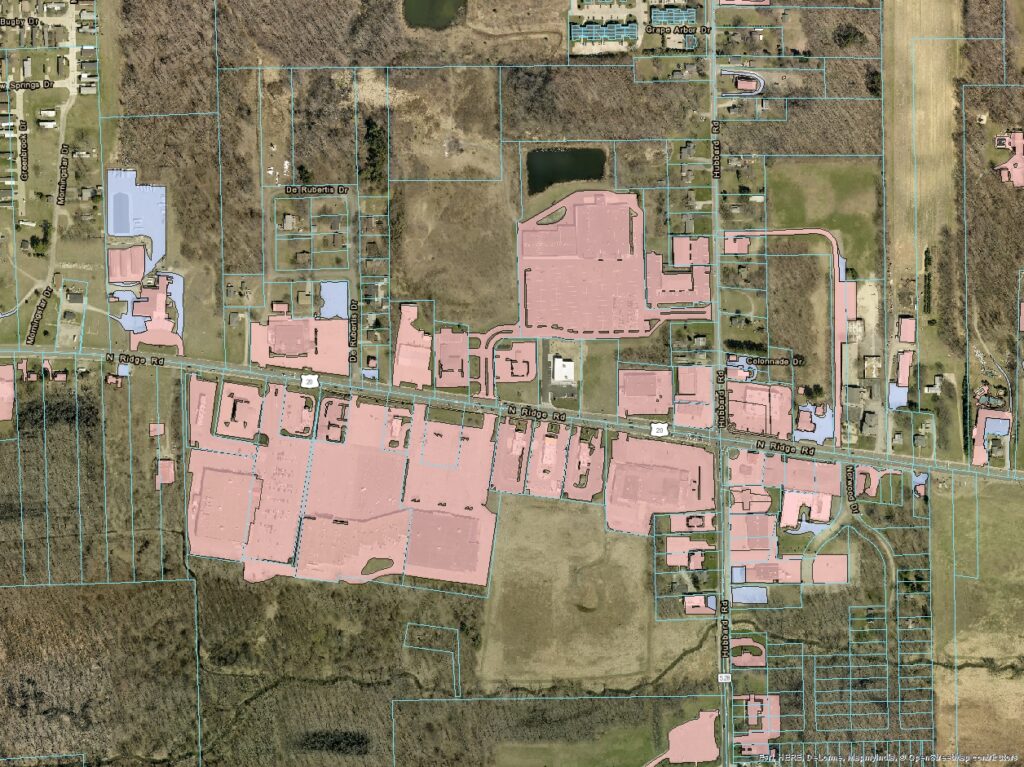

The federal mandate requires that local governments bear all costs associated with the new regulations, so Lake County instituted a Stormwater User Fee program. The fees are charged on individual parcels of land based on the amount of impervious area on the property (hard surface). The amount of impervious land is used because it has been shown to be a good indicator of the amount of runoff that leads to pollution

How Are Residential Properties Charged?

All residential properties are charged a flat rate based on an average impervious area of 3,050 square feet for each parcel. Your councilmen elect chose to participate as a Level 2 member community. Therefore, you are charged $3.50 per month or $42.00 annually.

How Are Non-residential Properties Charged?

Your councilmen elect chose to participate as a Level 2 member community. Nonresidential properties are charged based upon the square footage they contain divided by the equivalent residential unit (ERU) which is 3,050 sq.ft. For example, a commercial property of 9,150 sq. ft., which is equal to 3 ERU, would be charged $10.50 per month.

(Photo depicts impervious areas, shaded in pink and blue)

Do You Think You Have Been Improperly Charged?

If a property owner feels that they have been improperly charged for their User Fee, they have the option of submitting a User Fee Adjustment Request (pdf file) to our department. This form can either be downloaded with the above link, or requested from our office.

Please remember the following:

- Application must have complete Property Owner information. Any incomplete applications will be returned to property owner for corrections.

- Applications must be submitted to our office within 30 days of receipt of bill.

- Once completed application is received, it will be reviewed and verified by our department. If approved, confirmation of adjustment will be sent to mailing address of property owner on application. If disapproved, a letter stating the reasons why will be sent instead. Any disputes must be submitted in writing for review by Director and/or Advisory Board.

- Please allow 2-3 weeks for processing of adjustments.

To view your tax bill online, visit the Lake County Auditor’s website.