Treasurer

2024 PAY 2025 due dates:

- 1st Half due date Wed. Feb. 19, 2025

- 2nd Half due date Wed. July 16, 2025

- BILLS AVAILABLE NOW ONLINE

- Mailed bills were sent June 11, 2025

- Please go ONLINE or contact us if you have NOT received a bill by July 1st

Main Office Hours 8:00-4:30 Mon-Fri

Drive Thru Express HOURS

- OPENING JULY 9 – JULY 16

- MON-FRI 8:00-3:30

- OPEN SATURDAY 8:00-NOON

- July 12

12 MONTH BUDGET PLAN

BUDGET your property taxes. No sign up needed. Send payments in any amount, at any time by selecting “Pay Other Amount.” on our Payment Portal. It’s safe and secure.

- Balance bills sent in January and June

- Call 440-350-2516 for assistance

We’re going ELECTRONIC:

- FREE recurring Auto Pay form required

- FREE Pre-Pay Monthly AutoPay form required

- Starts every August 5th

- signup by June 21st

- Must be paid current

- Pay online through our Payment Portal

- Credit/Debit

- Google/ Apple Pay

- E-check

- Pay with YOUR Online Bill Pay

- Parcel # = Account #

- Payable to Lake County Treasurer

- You decide when and how much to send

- Submit payments in our Drop Box, conveniently located in our parking lot

- Mail check payments to: Lake County Treasurer, 105 Main St., Painesville, OH 44077

- Visit our main office at 105 Main St., C102, Painesville, OH 44077 8:00-4:30 Mon-Fri

New Delinquent Plans

New delinquent plans are available. Appointments and down payments are required. Please call 440-350-2473 or email [email protected]

Property Search Guidelines to Find your Bill:

Online bills can be accessed on the AUDITOR’S WEBSITE

- Conduct a property search

- Please fill in only one field when searching i.e. Parcel ID # or Address #

- Use CAPITAL LETTERS and NO dashes

- Tax summary updates nightly

- Tax bills updated monthly (may be different than tax summary)

Latest News

Treasurer Resources

| Name | Job Title | Phone | |

|---|---|---|---|

| Criswell, Erin | Deputy Treasurer | 440-350-2517 | [email protected] |

| Della-Serra, Brittany | Deputy Treasurer | 440-350-2472 | [email protected] |

| Falkenberg, Sherri | Chief Deputy Treasurer | 440-350-2540 | [email protected] |

| Gumm, Lori | Deputy Treasurer | 440-350-2477 | [email protected] |

| Nicholson, Katie | Deputy Treasurer | 440-350-2519 | [email protected] |

| Nolen, Sally | Deputy Treasurer | 440-350-2515 | [email protected] |

| Payne, Joyce | Deputy Treasurer | 440-350-2518 | [email protected] |

| Potter, Karen | Deputy Treasurer | 440-350-2473 | [email protected] |

| Zuren, Michael | Treasurer | 440-350-2480 | [email protected] |

| Title | Description | Date |

|---|---|---|

| Auto Pay Direct | Auto Pay Direct | |

| Change / Correction of Mailing Address | Change/ Correction of Mailing Address | |

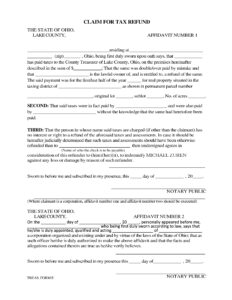

| Claim for Tax Refund | Claim for Tax Refund | |

| Military Tax Deferment Form | Military Tax Deferment Form | |

| Remission of Penalty | ||

| Remission of Penalty Form R.C. 5715.39 | Remission of Penalty Form R.C. 5715.39 | |

| Tax Prorations | Request for Pro-Rated Taxes |

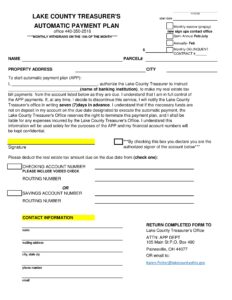

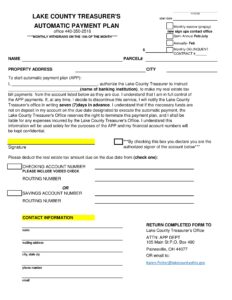

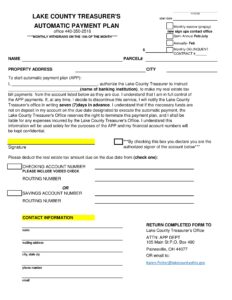

- What is the Automatic Payment Plan?

It is an automatic method of paying your real estate tax bill. It is similar to direct deposit of social security checks or payroll checks, except the APP pays your real estate tax bill by debiting your checking or savings account.

- Will it cost me anything to sign up for this payment service?

No. There is no charge for this service to the taxpayer.

- What are the benefits of paying with the APP?

It is a convenient, easy way to pay your tax bill without taking the time or trouble to write and record a personal check, find an envelope and stamp, and mail the payment. It is an automatic way to pay your bill when you are out of town.

- I am currently participating in another payment service program, can I continue to use this other service to pay my real estate tax bill?

No. You will need to cancel that service and complete the attached authorization form.

- How do I sign-up?

Complete the attached Authorization Agreement Form. If bills are going to be paid out of your checking account, attach a voided check. Mail completed form to: Lake County Treasurer’s Office, Attn: David Blanock 105 Main Street Painesville, OH 44077-0490

How will I be notified of my bill amount and when my checking or savings account will be automatically debited?

After you return the authorization form to the Lake County Treasurer’s Office and your banking information is confirmed accurate, you will be notified by mail. The message on your bill will read: “NOTICE: THIS BILL IS PROVIDED FOR YOUR RECORDS AND REQUIRES NO PAYMENT. A CHARGE OF (Amt due) WILL BE SENT TO YOUR BANK ON (The Due Date).”

- If I have a credit on my account, will I be reimbursed through the APP?

No. The credit will be applied to your real estate taxes on future billings. If you have a large credit that will take time to be absorbed through future billings, call a Lake County Treasurer’s Office representative for a possible refund. The message on your bill will read: “NOTICE: THIS BILL IS PROVIDED FOR YOUR RECORDS AND REQUIRES NO PAYMENT. YOUR ACCOUNT HAS A CREDIT BALANCE. NO CHARGE WILL BE SENT TO YOUR – BANK.”

- How will I know that my bill has been paid?

Your real estate tax payment will be reflected as a separate item on your checking or savings account statement.

- Who do I contact if I disagree with the amount of my real estate tax bill and wish to put a hold on the APP until further research?

Call Lake County Treasurer’s Office at (440)350-2516, (440)918-2516 or (440)298-3334 Ext. 2516 no later than five days prior to the due date. A billing representative will assist you. Let the clerk know you are on the APP and would like to put a hold on the payment.

- If I am moving and or selling my home, will my Final Bill be paid through the APP service?

No “Final Bills” will be considered in the APP. This will avoid problems that arise when a bank account has been closed prior to the due date or duplicate payments are made by the Title Company or customer.

If you are selling your home and wish to continue the APP service for payment on your taxes for your new home, a new authorization agreement form would need to be completed.

- What happens if I change banks or close my account?

As soon as you know that you will be changing or closing your account, contact the Lake county Treasurer’s Office. If you wish to continue paying by the APP, an authorization form for your new bank account must be completed.

- Can I continue the APP service if the funds are not on deposit in my account on the designated day the APP is executed?

The service for APP will be terminated effective when the funds become insufficient. The customer will be liable for any expenses incurred by the Lake County Treasurer’s Office.

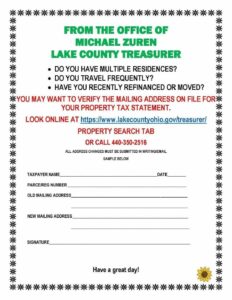

- Did your mailing address change?

| Title | Description | URL |

|---|---|---|

| E-Statement Sign-up | Sign up to receive your real estate tax bill via email | https://lakecountyohio.smartpayworks.com/ |

| Public Records | https://www.lakecountyohiorecorder.com/ | |

| Real Property and Tax Information | https://auditor.lakecountyohio.gov/search/commonsearch.aspx?mode=realprop | |

| State of Ohio Unclaimed Funds | https://www.com.ohio.gov/unfd/ |