Agriculture

For over 60 years, soil and water districts have been working with the agriculture industry to conserve and protect soil resources. Lake SWCD continues that tradition by providing technical advice and assistance for owners of agricultural lands, and promoting local agricultural-based businesses. We are also working to protect the unique vineyard growing region of Northeast Ohio through education, conservation and sustainability of the industry.

Agricultural Economic Impact Studies Series

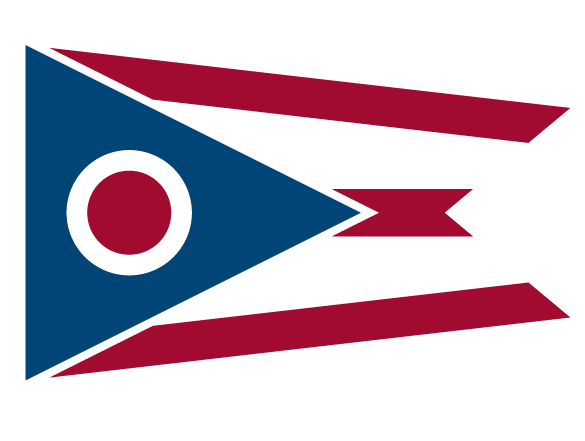

Nurseries and produce farms account for much of the agricultural land use in Lake County, which is consistently one of the highest ranked counties in Ohio in terms of income from agriculture. Vineyards are an appealing sight along the Grand River.

Lake SWCD partnered with other agencies to assess the economic impacts of the agricultural industries in Lake County between 2007 and 2013. Click on the links below to view the individual reports.

An Economic Impact Analysis of Lake County Agriculture, Executive Summary July 2014

Agriculture’s Economic Impact in Lake County Ohio, Executive Summary, July 2014

Economic Impact Analysis of the Crop, Livestock, Viticulture, and Horticulture Industries in Lake County, Ohio for the Lake County Soil & Water Conservation District, August 2013Economic Impact Analysis of the Crop and Livestock Industries in Lake County, Ohio for the Lake County Soil & Water Conservation District, February 2013

Results of the Lake County Nursery Industry Survey, December 2009

Executive Summary

Cost of Community Services Study for Madison Village and Township, Lake County, Ohio, March 2008

The Northeast Ohio Grape and Wine Economic Impact Study, November 2008

Land Preservation Tools

The mission of Lake County Soil & Water Conservation District (SWCD) is to provide the leadership and technical expertise to guide the protection and conservation of the unique soil and water resources of the county. This includes not only promoting the wise use of our resources, but efforts to preserve our remaining agricultural lands. We endorse farmland preservation techniques along with sustainable agricultural practices to help retain the agricultural viability in our region. In this section you will find tools to help protect your farming operation and your land.

Current Agricultural Use Valuation (CAUV)

The Current Agricultural Use Valuation (CAUV) program benefits farmland owners by taxing farmland at its agricultural value, rather than its potential full market value. The CAUV program became law in 1974 and is administered by the county auditor. To be eligible, land must have been in agricultural use for three years prior to application; it must be 10 acres or more or generate an average gross income of $2,500 per year. There is an annual renewal for the program. There is a recoupment penalty if the land is taken out of agricultural production, in the amount of the difference between the agricultural value taxes and the full market value taxes for a three-year period. For more information or to enroll, contact Brian Rodgers at the Lake County Auditor’s office, at 440-350-5845; [email protected].

Agricultural Districts allow farmers to form special areas where commercial agriculture is encouraged and protected. Enabling legislation for agricultural districts was passed in Ohio in 1982 and enrollment in agricultural districts is voluntary. Enrollment in an agricultural district provides protection to farmers against nuisance suits and defers assessments on construction of water, sewer and electric lines. It also gives a level of protection against eminent domain proceedings by requiring an additional level of review before land can be taken.

The county auditor administers the Agricultural Districts program and the criteria for enrollment are similar to those for the CAUV program. The property must be at least ten acres, but, unlike the CAUV program, the renewal period is every five years. Enrollment in the CAUV program does not automatically cause a landowner to be enrolled in the Agricultural Districts program. Farm owners must apply separately to each program. Many landowners mistakenly believe they are protected by the Agricultural Districts program when they apply for CAUV. Check with the Auditor’s office to make sure you are enrolled in both programs. Contact Brian Rodgers at the Lake County Auditor’s office at 440-350-5845; [email protected].

The Ohio Agricultural Security Area (ASA) Program was authorized in 2005 to offer farm owners additional protection from development pressures. To qualify for this program, the area must be 500 contiguous acres (which can include several landowners), operated according to best management practices, enrolled in an agricultural district and enrolled in the CAUV program. The program has a 10-year renewal period. Applications are made to the county commissioners and the township trustees. Lake SWCD and the Ohio Department of Agriculture (ODA) will assist landowners and communities with the implementation of this program.

The county and townships agree not to initiate, approve or finance any non-farm development in an ASA, such as extension of sewer or water lines or the construction of new roads. Landowners may apply to the county or township for a tax exemption for up to 10 years and 75 percent for any agricultural real property investment of $25,000 or more. Contact Lake County Soil & Water Conservation District at 440/350-2730 or [email protected] for further information.

Agricultural Conservation Easements

An agricultural conservation easement is a deed restriction that landowners may place on their land to protect it from development. The landowner retains all the rights of property ownership, except for the right to ever develop the property. The easement is recorded with the deed and remains a restriction on the property in perpetuity. Conservation easements are used to protect natural resources, wildlife habitat, historic sites or scenic views, to name a few. Agricultural easements are conservation easements that are more specifically crafted to protect productive agricultural land and working farms.

Agricultural easements may be donated or sold by landowners to a qualified conservation organization or government body. Lake SWCD is qualified to hold conservation and agricultural easements, and has held easements since 1996.

Landowners who donate the value of the easement (the fair market value of the property minus its restricted value) may be eligible for state and federal income tax charitable deductions, as well as a reduction in the value of the property for estate tax purposes.

There are two easement purchase programs that can pay landowners who wish to be compensated for selling the right to develop their land: the Federal Agricultural Land Easement (ALE) program and the Local Ohio Agricultural Easement Purchase Program (LAEPP). (See below.) Both are very competitive programs, and requests far exceed the available funding.

Lake SWCD recommends that landowners who are considering establishing an easement on their property consult a tax advisor who is well versed in conservation easements to understand all the implications of a donated or compensated easement.

Local Ohio Agricultural Easement Purchase Program (LAEPP)

The LAEPP is administered by the Ohio Department of Agriculture. Applications are made by a sponsoring agency, such as a soil & water conservation district or private land trust, on behalf of interested landowners. Lake SWCD has submitted applications on behalf of landowners every year since the implementation of the program. There is an annual funding round, and applications are usually due in early spring.

The LAEPP pays qualifying farmers a portion of the cost to establish a conservation easement on their farms. It is a very competitive program and is open to farms of 40 acres or more that are enrolled in both the CAUV and the Agricultural Districts programs. Applications are evaluated on the basis of soil types, management practices, proximity to protected land, development pressure, local comprehensive plans and other factors, such as enrollment in an agricultural security area and a Century Farm or other historic designation.

Contact Lake SWCD if you would like to make an application.

Agricultural Land Easement (ALE)

The ALE is a Federal program that helps farmers and ranchers keep their land in agriculture. It provides matching funds to state, tribal, local governments and non-governmental organizations to purchase perpetual conservation easements. USDA will provide up to 50 percent of the costs of purchasing an easement to qualifying landowners.

To qualify, the land must contain prime, unique or other productive soil or historical or archaeological resources; be privately owned, large enough to sustain agricultural production, accessible to markets for what the land produces, surrounded by parcels of land that can support long-term agricultural production and have a conservation plan.

Applications are made by Lake SWCD on behalf of interested landowners. There is an annual funding round.

Donated Easements

Landowners may donate agricultural easements to the Ohio Department of Agriculture (ODA) Agricultural Easement Donation Program (AEDP), Lake SWCD or a land trust such as the Western Reserve Land Conservancy. The organization that holds the easement enforces the terms of the easement to ensure that the terms of the easement are adhered to over time. Landowners are advised to seek advice from a tax advisor well versed in the tax implications of easement donations. For further information about donating an easement, contact Lake SWCD.

Farm transition and estate planning are essential parts of preserving the farm for successive generations. Estate planning should address the needs of all the family members, including those who leave the farm, as well as issues of retirement and possible disability. A will is an important part of an estate plan, but does not secure the future of the family’s farm and farm business. Estate planning should accomplish at least four goals:

Transfer ownership and management of the agricultural operation, land and other assets

Avoid unnecessary income, gift and estate taxes

Ensure financial security and peace of mind for all generations

Develop the next generation’s management capacity

The Ohio State University Cooperative Extension Service has many resources to help with estate planning and transferring your farm to the next generation.

Land Conservation & Stewardship Tools

Contact the Natural Resources Conservation Service (NRCS) office in Orwell for information about the Conservation Reserve Program (CRP), Environmental Quality Incentives Program (EQIP), Wildlife Habitat Incentives Program (WHIP) and other conservation programs at 440-357-5888.